The decentralized finance (DeFi) industry has experienced unprecedented growth in recent years, radically transforming the financial landscape. Thanks to DeFi, a wide range of financial products can now be accessed democratically. Swaps, loans, derivatives, and insurance are just some innovative products that have made DeFi accessible to anyone, breaking down traditional barriers to accessing the financial system. However, despite the many benefits of DeFi, the returns associated with this new form of investment have been significantly affected by recent bearish market conditions. Investors faced a reality in which income sources were no longer as sustainable as in the past. In response to this challenge, solutions were urgently needed to provide more stable and sustainable income in DeFi. And this is where protocols that generate a return from real-world assets (RWAs) come in.

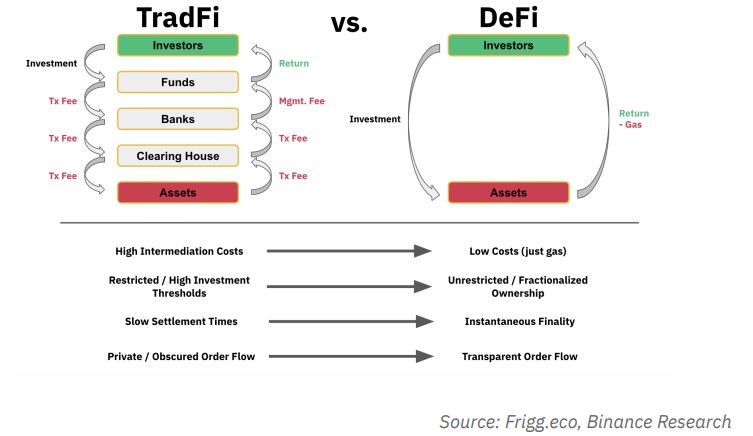

Traditional finance, or TradFi, represents our conventional financial system in which financial institutions dominate operations. These institutions include banks, hedge funds and brokers, to name but a few. The distinguishing characteristic of TradFi is its high degree of centralisation, the control exercised by financial institutions and the exclusion of retail investors from many financial services available in the cryptocurrency sector. In other words, in TradFi, access to services such as participation in Automated Market Making (AMM) or investment in trading companies through instruments such as flexUSD is limited and reserved mainly for institutional players. Individual investors have limited opportunities to benefit from these decentralised financial services offered by cryptocurrencies, which are characterised by greater openness and participation. TradFi is characterised by a centralised organisation of the financial system, where decisions and control are mainly in the hands of established financial institutions. In contrast, the cryptocurrency sector offers a more decentralised perspective, allowing individuals to access various innovative financial services previously exclusively reserved for institutions. This difference in approach and access reflects the gap between traditional and decentralised cryptocurrency finance.

Contents

What are RWAs?

Tangible world assets (RWAs) are an increasingly important component in the financial landscape, as they bridge the gap between traditional and decentralised finance. Initially, these assets were seen as a way to introduce physical resources into DeFi. However, the standard definition of RWAs as tangible assets in the physical world, such as real estate or works of art, is not entirely accurate.

As a first step, it is essential to distinguish RWAs from NFTs (Non-Fungible Tokens), which have received much attention in recent years. Although RWAs may seem similar to NFTs according to the above definition, it is necessary to specify that NFTs are digital assets linked to physical support. In contrast, RWAs are collateralised by physical assets. Usually, developers use intelligent contracts to create a token representing an RWA, providing an off-chain guarantee that the issued permit can always be redeemed for the underlying asset. It must also be specified that NFT and RWA can create a perfect combination, which we will see later in this article.

This limited definition must do justice to RWA’s whole reality and potential. Besides the on-chain representation of physical assets, RWA is based on any present or future revenue stream or cash flow, such as the company’s balance sheet or streaming video content. Therefore, there is a need to broaden the perspective and consider RWA as any asset on a balance sheet that can be used as collateral, allowing lenders to gain exposure to real-world returns of various kinds.

The new perspective has opened up new possibilities for financial institutions and traditional industries, as RWAs allow them to exploit the benefits of blockchain products and DeFi, overcoming the constraints of traditional financing models. The enormous potential of RWAs is increasingly emerging, opening up new opportunities for financial innovation and creating stronger connections between the physical and digital worlds.

How does it work?

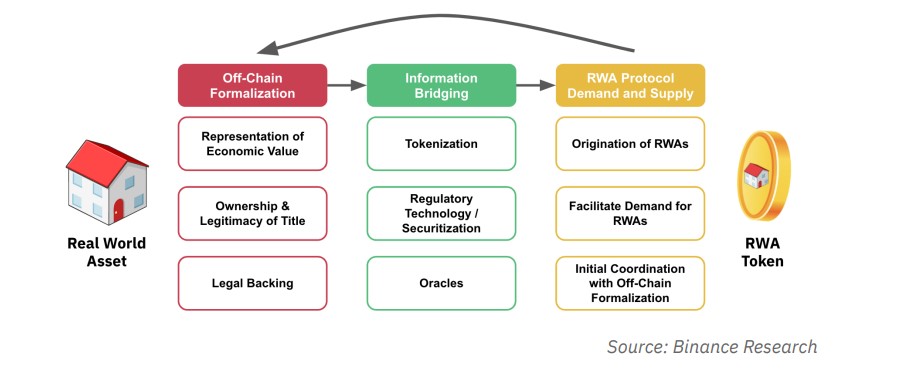

Transforming RWA tokens into legitimate bearer assets can be divided into three conceptual steps: off-chain formalization, information transfer on the blockchain, and supply and demand management through the RWA protocol.

Off-chain formalization is the crucial first step in introducing natural resources into DeFi. This process requires a clear understanding of the asset’s economic value, the identification of the owner and the definition of the legal processes that protect it. Monetary value can be expressed through different metrics, such as market value or historical performance. The ownership of the asset is formalized through legal documents, such as deeds or invoices, and it is essential to have well-defined dispute resolution and settlement procedures to deal with any disputes. These steps are necessary to ensure transparency and security of asset ownership rights in DeFi.

Next, information about the economic value and ownership of the asset, formalized off-chain, is transferred to the blockchain and stored. This process is done by translating the data into code and representing it through metadata in a digital token known as ‘tokenization’. In this way, the economic value and ownership of the asset become transparent. For purchases that require regulation, specific technologies are available that allow them to be legally integrated into DeFi. Furthermore, access to external data is needed to represent off-chain assets’ value accurately. However, blockchains do not have direct access to centralized sources, so decentralized oracles, such as Chainlink, are used to provide data on off-chain assets to DeFi protocols.

DeFi’s specialized RWA protocols manage the entire supply and demand process. From the supply side, these protocols oversee the origination of RWA, while from the demand side, they facilitate the demand of investors interested in RWA opportunities. Consequently, DeFi’s RWA-focused protocols act as a starting point for the issuance of new RWA and as a marketplace for trading RWA. A concrete example is the RealT platform, which operates in the US real estate market by offering fractional ownership through tokenization. Investors can buy a part of a property without purchasing the entire property. On the other hand, property owners can sell a fraction of their property to diversify their property portfolio. RealT is a starting point for issuing RWAs and a market for RWA trading.

In other words, a three-step process must be followed to convert a real estate property into an RWA digital token on the RealT platform. Initially, it is necessary to submit the property to an appraisal by a third-party professional to certify its ownership and confirm its value. Next, the ownership information is connected to the blockchain through tokenization, securitization and transmission via oracles. RealT does not directly tokenize physical ownership but rather the shares of a limited liability company (LLC) that holds the deed. This approach allows for compliance with US securities regulations and the legal inclusion of investors via a built-in identity validation (KYC) technology. Finally, RealT uses oracles to provide a fair market valuation for the property. The platform originates new RWA tokens and lists them to meet investor demand. In this way, RealT acts as a conduit between traditional real estate and the DeFi ecosystem, enabling investors to participate in this innovative marketplace.

What are the benefits of RWAs?

We can identify them in three main categories: debt issuers, users of RWA protocols and the cryptocurrency market.

For debt issuers, the adoption of RWAs has several advantages. First, they can free up capital more efficiently, allowing them to use resources flexibly for investments or other activities. In addition, borrowing becomes faster and more straightforward, reducing reliance on expensive and complex intermediaries. Debt issuers can retain more control over the terms and generation of loans, tailoring them to their specific needs.

Users of RWA protocols benefit from easier access to sectors and yields that would otherwise be difficult to access. This helps democratise the debt market, allowing a wider audience to participate in investment opportunities previously reserved for a privileged few. Furthermore, users can limit the correlation of their portfolios by investing in products that show lower correlation with digital assets, offering greater diversification and mitigating risk.

As far as the cryptocurrency market is concerned, the introduction of RWAs can bring several benefits. First, it can increase the Total Value Locked (TVL) in DeFi, i.e. the total value of the funds locked in the protocols. This contributes to increased liquidity and ecosystem growth. Furthermore, RWAs can reduce the extreme correlation between crypto assets, offering less volatile and more stable investment opportunities. This can attract new participants outside the blockchain ecosystem, opening the door to wider adoption of the technology and promoting greater stability.

A look at the market:

Looking at the current market, we note that financial markets for shares and tangible world assets (RWAs) still need to be expanded, with few protocols in development. This limitation is partly because these assets are commonly traded in public markets, subject to regulation and only offered by registered companies and controlled exchanges. In addition, financial instruments representing shares or tangible assets often involve the need to manage the physical off-chain ownership of the underlying asset, adding operational complexity to the protocols that facilitate such transactions.

For example, the Backed Finance protocol, one of the few that offers public RWA shares, must be registered by the Swiss DLT Act, and the underlying shares must be held for redemption. These factors limit the availability of options to tokenize and trade shares and tangible assets. Instead, the fixed-income market stands out as the most predominant market. Unlike equity and fundamental asset markets, RWA-based fixed-income markets are characterized by a more active transaction flow, a greater variety of offerings and a broader diversification of market participants. In particular, fixed-income markets offer both public and private loans. In the context of DeFi, private credit-based RWA loan offerings are ubiquitous and represent a total value of more than USD 4 billion, divided into 1,560 different loans.

This innovation in private lending has allowed non-traditional borrowers and investors to benefit from previously inaccessible markets. Borrowers can now access a new market of lenders by splitting and reducing liquidity barriers. At the same time, DeFi investors can gain exposure to private credit markets previously reserved for credit funds and other institutions with substantial capital and personal connections. This democratisation of RWA-based fixed-income markets has opened up new opportunities for investors and borrowers, expanding access and participation in these markets.

What are the use cases?

Current RWA (Real World Asset) protocols are mainly applied in cryptocurrency lending, particularly stablecoins, using RWA as collateral. These protocols evaluate the collateral the borrower provides and calculate the loan’s total amount. The secured debt is then converted into an NFT (Non-Fungible Token) divided into a specific number of tokens representing the lenders’ share. These tokens are exchanged for stablecoins, which are then received by the borrower, thus making the loan effective.

Issued tokens and operating liquidity are combined in a debt pool, which the borrower manages as a liquidity pool. Lenders have the opportunity to purchase tickets belonging to senior or junior tranches. Junior tokens, although riskier, offer a higher yield, while old tokens are considered safer but with a lower result. When the loan matures, the issuer repays the NFT, and the lenders receive the initial principal plus interest, converting the tokens into stablecoins. During the loan period, the tokens accumulate interest, and the interest payments made by the borrower are added to the lender’s token holdings.

Companies in various industries use RWA protocols to raise capital, which is particularly beneficial for cash-strapped sectors such as supply chain, shipping or invoicing goods. These protocols allow companies to free up working capital by financing their receivables or pending invoices. This type of financing is often more flexible, faster and cheaper than traditional supply chain financing services offered by banks, which can be costly due to high fees and interest rates.

In addition, debt pool issuers set terms within RWA protocols, making them more convenient for many companies wishing to obtain financing. This flexibility and customisation of financial terms offered by RWA protocols is a significant advantage for companies, enabling them to meet their working capital and supply chain financing needs.

Conclusion:

It is important to note that adopting RWA protocols has challenges. The valuation and management of natural assets require special attention, as security and transparency must be ensured. Appropriate mechanisms must be developed to evaluate and monitor the underlying assets to ensure that returns are stable and that investors can trust the robustness of the protocols. Despite these challenges, the advent of RWA protocols represents a significant step towards the evolution of DeFi and creating a fairer and more efficient financial system. They offer a more sustainable and stable investment opportunity, allowing a more comprehensive range of people to participate actively in decentralised finance.

In the following article, we will dive into the world of the most interesting RWA use cases and projects currently on the market. In detail, we will explore some leading platforms, such as Ondo Finance, Centrifuge and many others. We will look at how these platforms are revolutionising how real-world assets are integrated into the cryptocurrency ecosystem and opening up new opportunities for investors and businesses.

I look forward to sharing these exciting innovations in Real World Assets with you.

DISCLAIMER:

Please note that no information in this post should be construed as financial advice. The content provided is for information purposes only and does not constitute a recommendation or invitation to invest. No liability is accepted for any loss or damage arising from investment decisions made from reading this post. You are always encouraged to make informed and responsible financial decisions based on your individual needs and the advice of qualified financial professionals.

Sources

- https://www.insights.sygnum.com/post/connecting-defi-and-real-world-asset-tokenization-a-multi-trillion-opportunity

- https://coinmarketcap.com/alexandria/article/real-world-assets-reshaping-an-archaic-concept

- https://research.binance.com/static/pdf/real-world-asset-report.pdf

- https://docsend.com/view/6zf4epj6n6swrim8

- https://coinmetrics.substack.com/p/state-of-the-network-issue-188

- https://dune.com/vaishnavpuri/real-world-assets-dashboard

- https://blockworks.co/news/what-are-real-world-assets-defis-newest-yield

- https://www.ft.com/content/69da37d1-11de-430f-8a86-ea51bd2ae82b